Residential Development

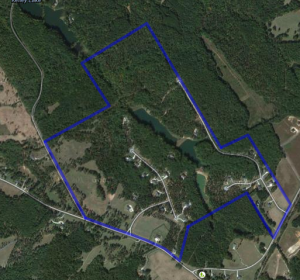

Property: This 311 acre tract of land in Walton County was purchased by an investment/development partnership that the Baker Group is a managing member of. The property was purchased in 1999 with the intention of reselling the property at a later date.

Property: This 311 acre tract of land in Walton County was purchased by an investment/development partnership that the Baker Group is a managing member of. The property was purchased in 1999 with the intention of reselling the property at a later date.

Issues: The property was a desirable tract of land covered in old growth hardwood trees, but needed something to help make it stand apart from other properties. The residential market for estate sized tracts (3-5 acres in size) in Walton County was very strong at the time, but there was no available product for this need. Also, a portion of the property was not shaped in a manner to allow estate sized tracts and needed to be rezoned so some lots could be 1-2 acres in size. Finally, the Baker Group had to manage the tax consequences to lessen the overall tax liability for the partnership.

Result: The Baker Group first built 3 lakes on the property to give it the added “something” it needed to make it stand out from other tracts of land. One of the partners in the partnership purchased 100 acres from the partnership and the Baker Group created a development plan for the remaining 211 acres – Alcovy Lakes. First, the Baker Group had to have a portion of the property rezoned, and negotiated with neighbors for concessions that were acceptable to the neighbors and acceptable to the development plan. Second, the Baker Group had to manage the process to minimize the tax burden. They structured the deal to have the partnership sell the property to itself (a separate development company) to give the partnership the ability to take advantage of the lower capital gains tax rate (15%) on the sale. Then the development company developed the land, sold the lots, and paid the higher ordinary income tax (up to 39%) on the sale of the lots. Without careful attention to this detail, the entire project could have been taxed on the higher ordinary income tax rate. Third, the Baker Group developed the property in the 1-5 acre estate size tracts with the average size being 3 acres. The Baker Group managed the development of the roads, the soil erosion control, creation of the Home Owners Association and Protective Covenants, installation of the utilities, the entrance monuments, and the construction of the Community Lot, featuring a park and lake access for all residents. Fourth, the Baker Group brokered the sale of the lots to those building their own custom homes and found a builder that built numerous spec and custom homes in the project. Because this project is an up scale development, our proforma showed the project would take several years to sell out. The development was started in 2004, the development loan was paid off in 2006, and by 2010 we have sold over half of the lots.

Israeli Investment Partnership

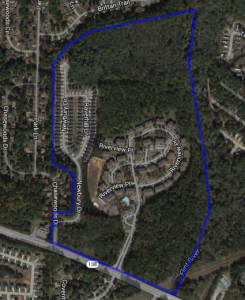

Property: This 92 acre tract of land in Clayton County, GA was owned by an investment partnership from Israel. They had purchased the land in the 80’s sand wanted to sell all or a larger portion in 1999.

Property: This 92 acre tract of land in Clayton County, GA was owned by an investment partnership from Israel. They had purchased the land in the 80’s sand wanted to sell all or a larger portion in 1999.

Issues: The sellers were from Israel and cultural differences in the way business is practiced created some challenges. Seventy nine acres of the property was zoned for 466 units of apartments and 13 acres was zoned commercial. Clayton County, in an attempt to thwart any development of apartments, changed the rules regarding apartment zoning after we put the property under contract with a developer. Clayton County officials actually told us the rule was enacted to make apartment projects financially unfeasible.

Result: The original developer dropped the deal because he said the numbers would not work with the new rules to which the County subjected the property. In 2000, we found another developer that would purchase a portion of the property to put 310 apartment units on. We negotiated a deal with him and for cross access, signage and utility easements for the property being sold and the clients remaining property. The deal was moving towards closing and we were 1 week away from the closing when the developer, who had paid $100,000 non-refundable earnest money, said his financing company would not close until he had his land disturbance permit. The County was dragging its feet and the closing would need to be delayed for 1 week. The seller, who had limited knowledge of real estate procedures in the U.S.A. initially said he would not extend because he gave his word on another deal in Israel and the developer should honor his word and close on the property in the time frame of the contract. After getting nowhere, the developer finally said, “If he won’t extend, we will forfeit our $100,000 earnest money and when the land disturbance permit is issued we will come back to you to close.” Finally, the seller agreed to the extension and the deal closed two weeks later. In 2002, we then found a residential developer and negotiated a deal on a portion of the remaining property. The commercial 13 acres is still retained by the Israeli investment group and they will hold it until the time is right to sell.